* Sage Business Cloud Accounting

Before you start

Decide on an activation date, from which you will start using summary reporting. All bookkeeping for transactions dated before this date should be handled manually as you're doing now. The balance in the FSB Ledger account should match the balance shown in the full list of transactions in Flight School Booking for the day before. It represents the total amount of money you are owed by your customers; in other words your Accounts Receivable. If you currently have all your customers listed in your bookkeeping package with non-zero balances, transfer their balance to FSB Ledger before you start.

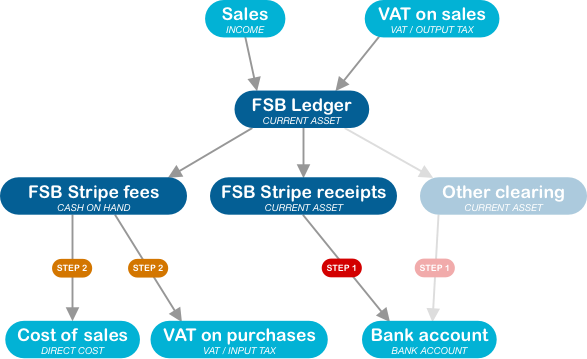

The diagram below shows the standard accounts in light blue and some new accounts in dark blue. These accounts act as clearing accounts for money in transit. This is either from invoices raised and not yet paid by your customers, Stripe fees deducted from payments but not yet invoiced, or payments from Stripe due but not yet paid into your bank account. The "Other clearing" account(s) are shown faintly on the diagram because these are optional, if you only accept Stripe payments you do not need them.

Most of these clearing accounts can be created by Flight School Booking during set up at Admin > Billing > Bookkeeping or you can create them yourself.

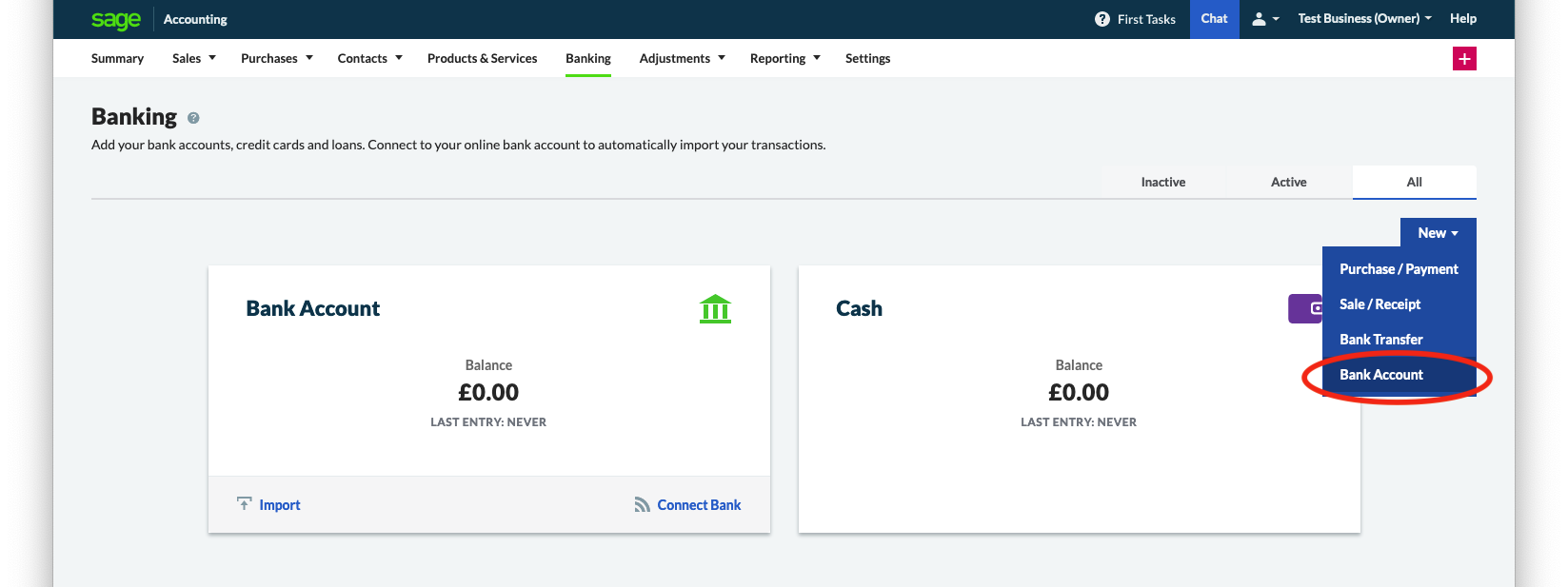

Please note FSB Stripe fees should be created via Banking as a "Cash In Hand" account because Sage only allows Stripe invoices to be paid from this type of account. We cannot create this kind of account automatically. To create this account yourself, open Sage and use the Banking tab to add a new Bank Account and set the type to "Cash In Hand".

Once the required accounts have been mapped to Sage, you should see something similar to the following. You can map any other accounts you want to. If you have created "adjustment" accounts in Flight School Booking for payments made outside Stripe, it is a good idea to prefix these with "FSB" (e.g. "FSB BACS Payments") so you can readily identify them.

Once all the required accounts and tax rates have been mapped, the export system can be turned on. Any transactions dated before the activation date will not be exported.

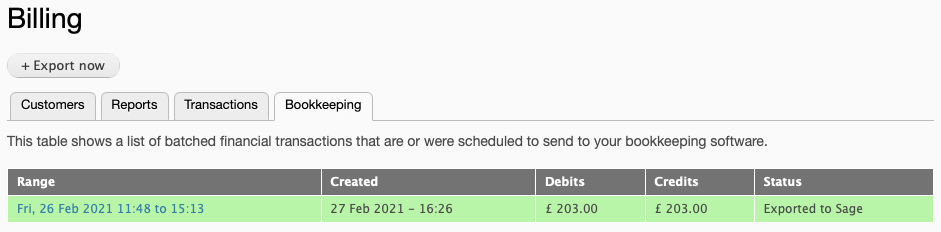

Flight School Booking runs a process overnight to creates manual journals, one for each day's transactions. You can view these on Billing > Bookkeeping.

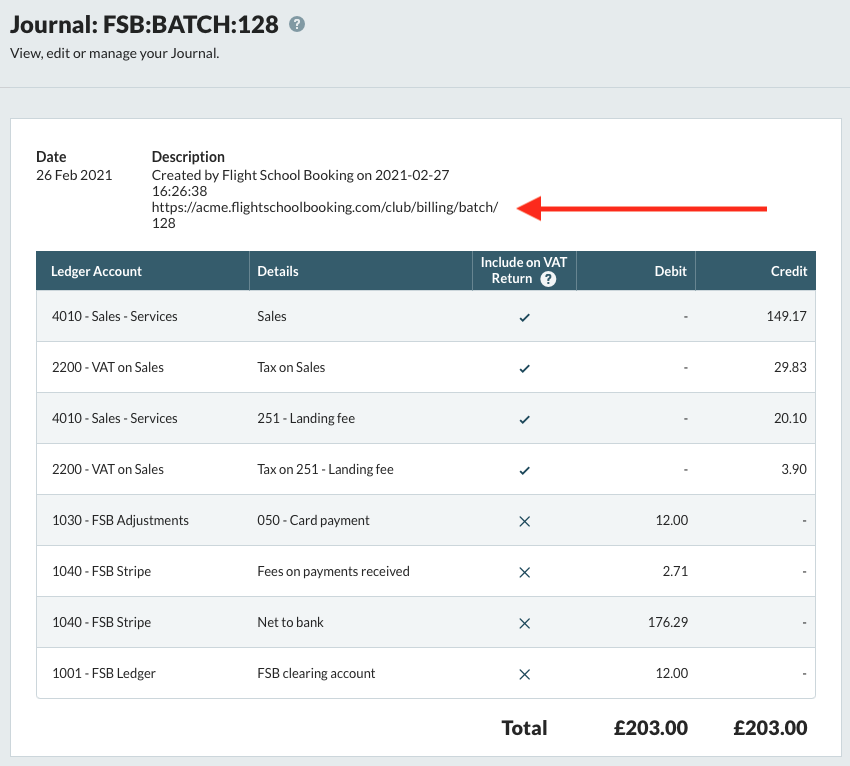

Unlike Xero, Sage has no facility to store a web address against a journal, but the Description field is used by Flight School Booking to store an address that you can copy and paste into a browser.

The address in the description field opens the relevant page in Flight School Booking containing the transactions that make up the summary manual journal. This is useful if you need to track down a specific entry contained in a summary transaction.

The process runs fully automatically, but there are some simple jobs you still need to do, labelled STEP 1 and 2 in the flow diagram at the top of this page.

- Reconcile your bank feed.

If you receive payments outside Stripe you recorded in Flight School Booking, reconcile your bank feed with the other clearing accounts (for example, FSB BACS Payments, FSB Cash and so on). As an example, if you receive cash for a sale, you will deposit this into the bank and reconcile the deposit to FSB Cash.

Reconcile your deposits from Stripe to the FSB Stripe receipts account.

- Account for Stripe fees.

When you receive an invoice from Stripe for their fees, enter it in Sage in the usual way. Then record the payment from FSB Stripe fees. This is the reason the account should be set up as cash / bank.