There are a number of financial reports available from Billing > Reports. These are visible to users with the Accountant or Owner roles.

- Accounting summary

- Sales and adjustments by accounts code

- Sales by tax code

- Sales by customer

- Sales by aircraft (hire only)

- Sales by instructor (training or ground school)

- Sales by product

- Payments processed (Stripe)

Report options

All reports can be run over a date range as shown:

Links

Look out for links in the reports. These allow you to drill down and investigate which transactions are included in a figure.

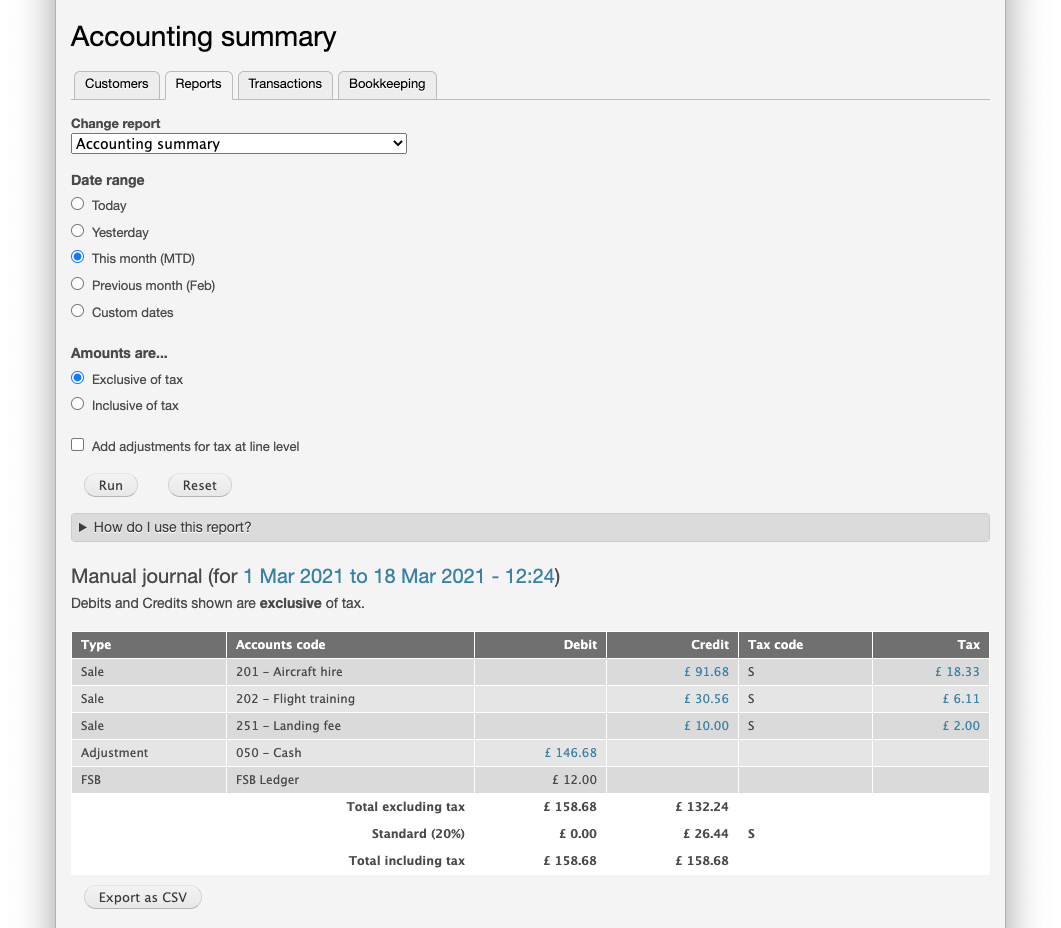

Accounting summary

The report shows a "manual journal" which can be entered into bookkeeping software to represent the sales and payments in the period. If you are using an integration with one of the supported bookkeeping packages this information is being sent automatically overnight. But if you use another less popular package for your accounts you can still enter the summary transaction instead of copying every invoice, credit and transfer. To find out how to enter the summary transaction using the information in this report, see Manual data entry.

Some bookkeeping software takes charge of the tax amounts and therefore introduces small rounding errors because Flight School Booking calculates tax at line level. To ensure the books are correct and agree with Flight School Booking, there is an option to Add adjustments for tax at line level. If your bookkeeping software allows you to specify the tax amount you can leave this turned off, otherwise turn the option on. This tells Flight School Booking to calculate the tax amount based on the total net sales per account and tax code. Where there is a difference between this and the totals from line level, the app will modify the figures slightly, adding additional lines at no tax to force the bookkeeping package into agreement.

Sales and adjustments by accounts code

This report shows a breakdown of net sales by accounts code. Net sales are the total income generated (after credits and tax taken off) in each account code.

The report also shows any transfers to other account codes such as opening balances, cash and direct to bank payments.

Sales by tax code

Shows the net sales broken down by tax code.

Sales by customer

This report shows the net sales broken down by customer with the highest income first in the list. This can be useful to show your best customers in the period.

Sales by aircraft (hire only)

When the system generates invoices for flying, it tags each with which aircraft was used. This report breaks down the net sales by aircraft, not including any flight training, circuit or landing fees. If your student prices for aircraft hire include the training element, this report is not going to be very useful. But if you separate out the aircraft hire and training rates the report will give a meaningful breakdown of sales value by aircraft.

Sales by instructor (training or ground school)

Invoices for flights with an instructor or ground school include information about who was instructing. This report breaks down net sales by instructor. Note another report under Training > Reports which shows a breakdown of number of training sessions, and total hours by instructor and accounts code.

Sales by product

This report shows a breakdown of net sales by price group or product.

Payments processed (Stripe)

This is a simple list showing payments processed by Stripe:

- Payments

Total card payments made by your customers using Stripe, displayed as a positive amount.

- Refunds

Refunds you have made using Stripe, or disputed transactions settled in the customer's favour are shown as a negative amount.

- Stripe fees

Stripe fees vary by country and by the cardholder's country. For each card payment, Flight School Booking records the fee amount. This is shown as a negative amount.

- Platform fees

If you are using the Gold Plan there are no platform fees. These are fees charged by Flight School Booking on card payments for online voucher sales while on the Silver Plan. Just like the Stripe fees, these are displayed as a negative amount.

- Net to bank

The total of all the above figures is the net to bank amount. This is the amount you will receive from Stripe for the period of the report. Since Stripe make payments according to the schedule you have set up with them, the amount is a guide for the period and not the actual deposit amount on a particular date.