The process for refunding is two steps.

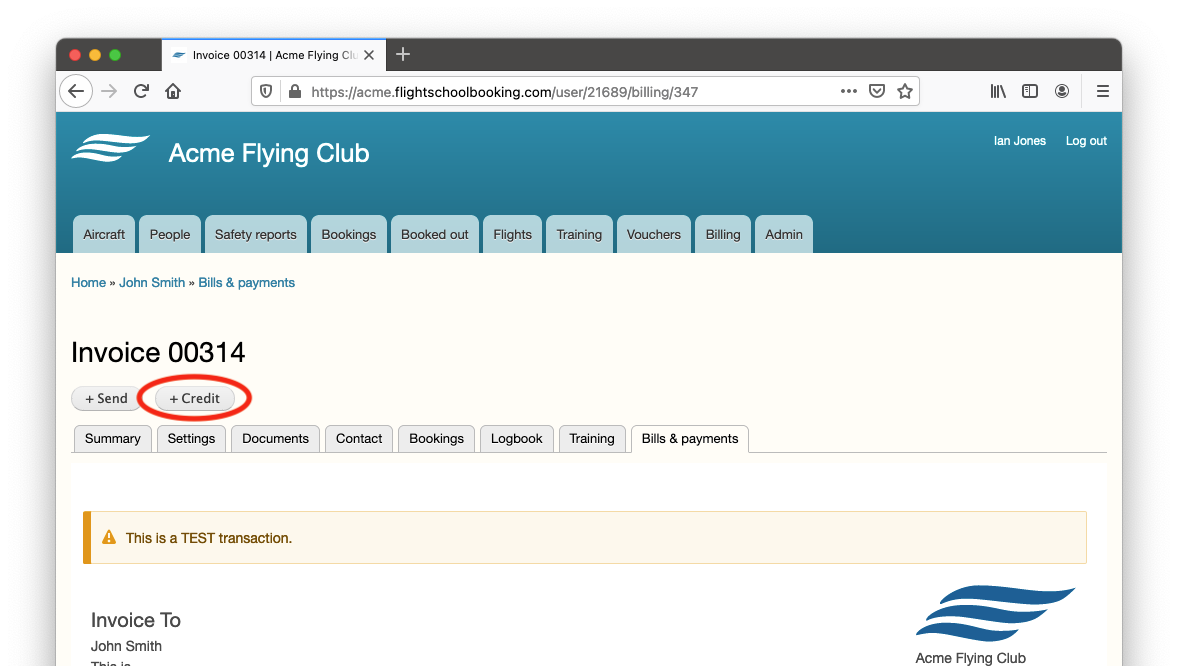

First, you should issue a credit note that itemises and describes what you are refunding for. The credit also contains the tax amounts, and if you are registered for VAT you can claim back this amount from your tax authority. You can add credits manually, but the most common method is to find the invoice first.

To credit some or all of an invoice back to a customer, click the Reverse button shown above the invoice. This creates a credit with all the same tax and accounts codes.

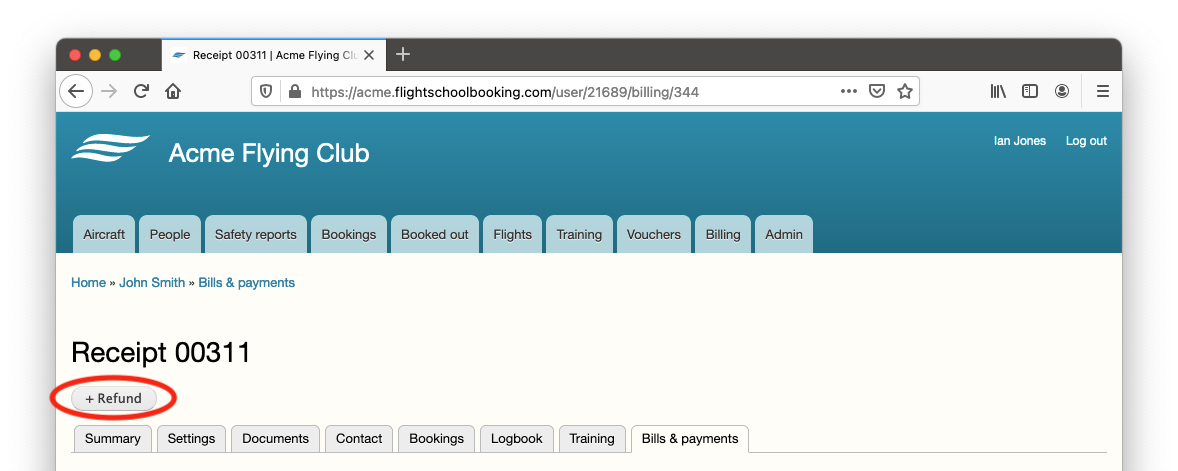

Next, you can try to refund back to the customer's card if they have used the billing system to make payments. Look for transactions of the type Receipt. If not, or if the last payment is over 90 days old, you will need to send them the money yourself and add an adjustment to their account manually (see Manual entries).

Assuming there is a recent receipt listed, click on it to view the details.

Click the Refund button. You can refund all or part of a payment, the system will keep track of when a payment is fully refunded.

Refunds you send direct from your Stripe account (eg the Stripe app or web page) are also reflected in the customer's account.