Before you start

Decide on an activation date, from which you will start using summary reporting. All bookkeeping for transactions dated before this date should be handled manually as you're doing now. The balance in the FSB Ledger account should match the balance shown in the full list of transactions in Flight School Booking for the day before. It represents the total amount of money you are owed by your customers; in other words your Accounts Receivable. If you currently have all your customers listed in your bookkeeping package with non-zero balances, transfer their balance to FSB Ledger before you start.

In your bookkeeping package, create the following accounts (ledgers).

| Name | Category | Comments |

|---|---|---|

| FSB Ledger | Current asset | This clearing account represents the Flight School Booking billing system in your books. Any balance on this account represents money you are owed by your customers. It should match the balance shown in the Billing > Transactions on a particular date. |

| FSB Stripe | Current asset | This clearing account contains fees and net payments due to you from Stripe. The receipt and fee amounts are known by Flight School Booking at the time of payment, before payments appear in your bank or they issue you with a tax invoice. You will receive a tax invoice from Stripe monthly which reduces the balance of this account, transferring to your Cost of Sales expense account. Depending on your bookkeeping package, you may need to set FSB Stripe to allow payments or change the type to a cash or bank account. |

| FSB XYZ | Current asset | Create clearing accounts for your other payment methods you have set up for adjustments such as Cash, BACS or Card Terminals. Reconcile cash deposits, bank transfers etc at your bank to the appropriate clearing account. |

| Stripe | Supplier | You may need to add Stripe as a contact if your bookkeeping package only allows bills to be created on suppliers. Bills from Stripe will be linked to your Cost of Sales and an appropriate VAT account. When "paying" the bill, pay from the FSB Stripe account. |

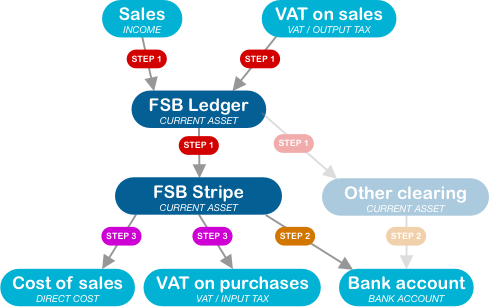

The diagram below shows your standard accounts in light blue and the new accounts you've added in dark blue. These accounts act as clearing accounts for money in transit. This is either from invoices raised and not yet paid by your customers, Stripe fees deducted from payments but not yet invoiced, or payments from Stripe due but not yet paid into you bank account.

Once set up, the bookkeeping process should be very much faster than entering the transactions manually.

- Add a manual journal

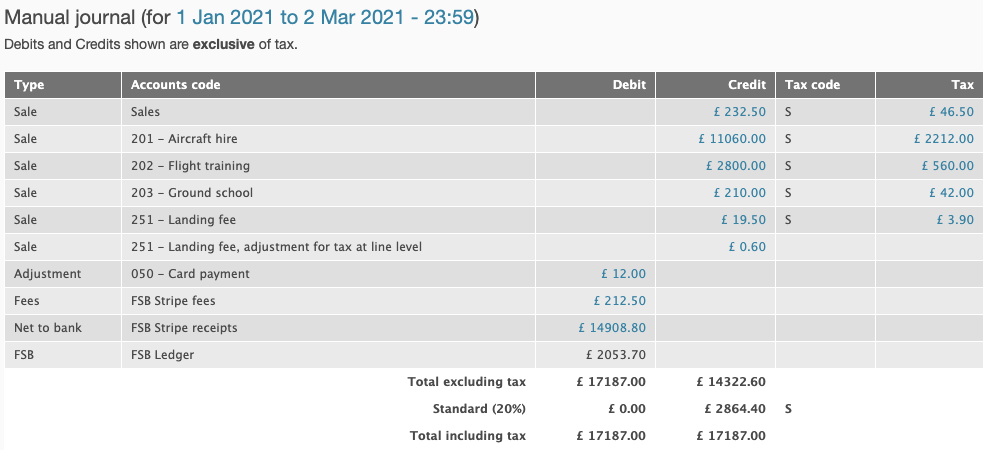

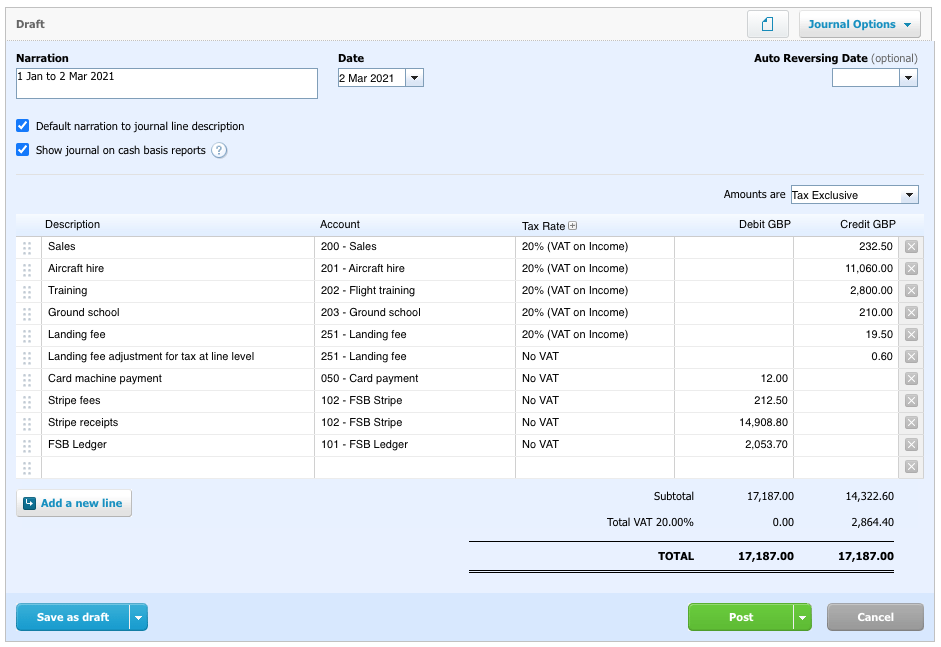

Once a month, run the Accounting summary report from the Billing tab for the previous month. The report lists the lines to enter into your books as a manual journal entry. If you enter adjustments for cash sales, these are also listed alongside the accounts code you set up under Admin > Billing > Adjustments. Any adjustments should also be to clearing accounts, later reconciled with the bank.

The following is an example of the report in action, and you will see later how the manual journal is created from it.

It doesn't matter which date you choose to enter the summary transaction under, but be consistent.

- Account for bank payments from Stripe

Stripe will pay into your bank account using the schedule you have set with them. Most bookkeeping packages automatically import from your bank account. Reconcile the payments to your bank from Stripe to the FSB Stripe account.

- Account for Stripe fees

Stripe produce tax invoices for their fees each month. Log in to Stripe and you'll find them under Settings > Documents.

Once you have downloaded the bill, enter it into your bookkeeping package like you would for any supplier invoice. Make a payment from the FSB Stripe account.

For one cycle, if all invoices have been paid by your customers, and payments from Stripe, and their fees have all been entered, you will find the balance of the clearing accounts are zero. These accounts allow you to record all your sales, tax, fees and payments received into the right places in your books without needing to account for every single one.

What about cash or direct to bank payments?

If you receive cash or bank transfers, you will have updated your customer's account under Bills & payments with an adjustment. Using account codes, you can distinguish how payments were made and you can create clearing accounts for these and reconcile the bank statement with the relevant clearing account.

If you need to refer to an individual invoice, or a customer's account, you can do this from Flight School Booking.