When someone pays for fuel using their personal money, you can use the system to pay them back. You will need the original receipt for fuel because you will account for this in your books.

The process only works if the customer is willing to receive the money in their flying account (reducing their next invoice amount). If you and your customer agree a cash exchange for the receipt this is outside Flight School Booking and does not appear in their account. You should account for the cash yourself and should not enter any information about the receipt into Flight School Booking.

Before you start

We recommend setting up a special "Fuel receipts" account code in Flight School Booking via Admin > Billing > Account codes. This will help you keep track of the receipts separate from cash, bank transfer and your other payment methods. The type should be set to "Adjustment".

If you haven integrated the system with your accounts, add a new account in your books. This should be a current asset, and should be capable of making payments. In Xero this means it should have "Enable payments to this account" ticked, and in Sage you will need to create it as a petty cash account, then map it to Flight School Booking on the Bookkeeping tab.

The process

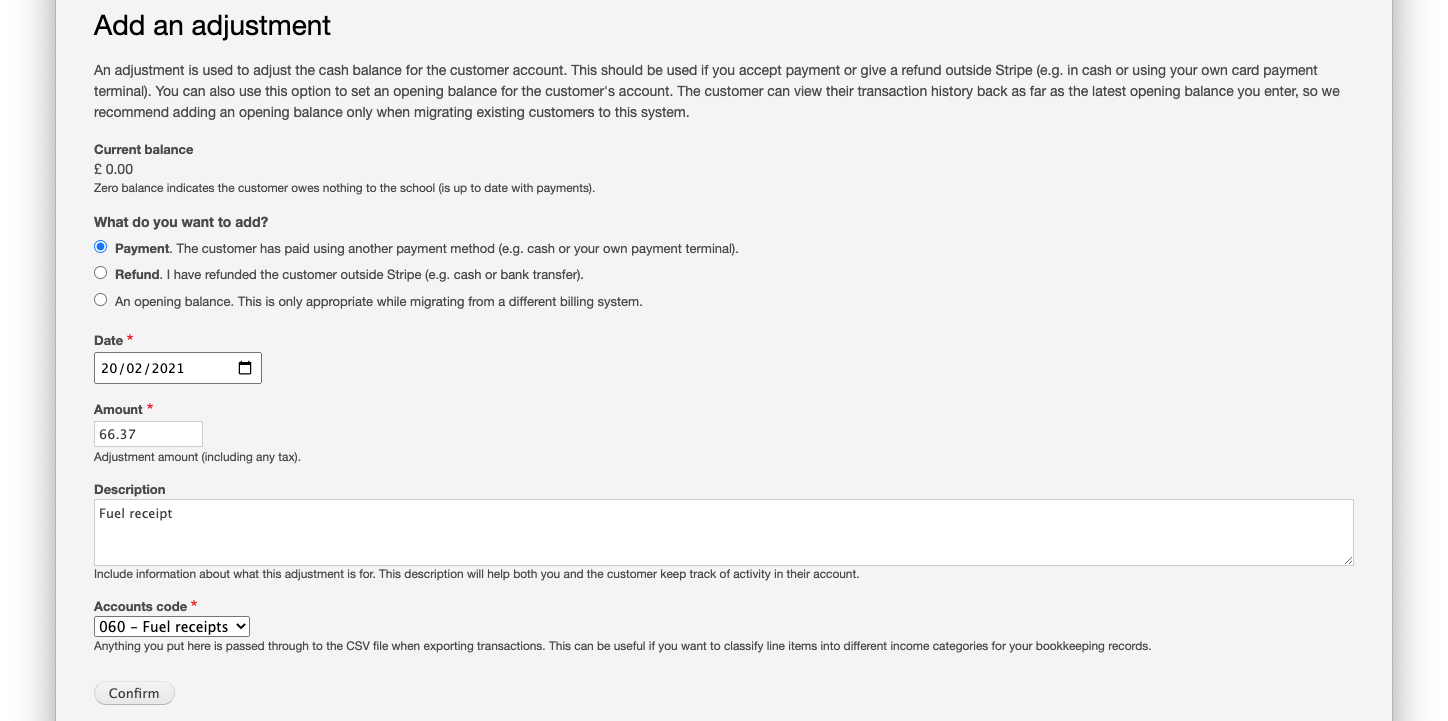

- To add the fuel receipt to your customer's account, find the customer's Bills & payments tab and click Adjustment.

- Choose Payment (the customer is effectively making a payment to you by giving you the receipt).

- If the receipt contains anything extra (e.g. confectionary) you should deduct this and only enter the fuel amount.

- Select your "Fuel receipts" account.

The customer's account is updated with the "payment".

The usual situation is that a customer has paid for fuel while on a trip, hiring your aircraft. Therefore, they will usually have an invoice for their flight in their account with a higher value than the fuel receipt. This means once payment is taken, they will pay a lower amount because some of the invoice will have been paid by the "payment" you just added.

If you are using the bookkeeping integration, the value of the receipt will appear in your "Fuel receipts" current asset account the next day. If you are in a hurry to account for the receipt you can manually trigger an update from Billing > Bookkeeping.

In your bookkeeping package, enter the fuel receipt as a bill, paid from the Fuel receipts account. You may need to record a bill first, then add a payment as a second transaction. Or some packages allow for a single entry from the Fuel receipts account, and you simply record the expense as a fuel (indirect) expense.