Before you start

Decide on an activation date, from which you will start using summary reporting. All bookkeeping for transactions dated before this date should be handled manually as you're doing now. The balance in the FSB Ledger account should match the balance shown in the full list of transactions in Flight School Booking for the day before. It represents the total amount of money you are owed by your customers; in other words your Accounts Receivable. If you currently have all your customers listed in your bookkeeping package with non-zero balances, transfer their balance to FSB Ledger before you start.

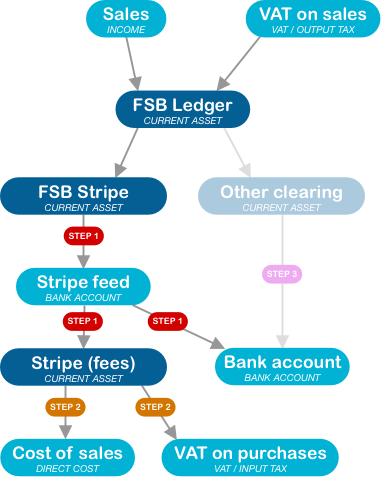

The diagram below shows the standard accounts in light blue and some new accounts in dark blue. These accounts act as clearing accounts for money in transit. This is either from invoices raised and not yet paid by your customers, Stripe fees deducted from payments but not yet invoiced, or payments from Stripe due but not yet paid into your bank account. The "Other clearing" account(s) are shown faintly on the diagram because these are optional, if you only accept Stripe payments you do not need them.

These clearing accounts can be created by Flight School Booking during set up at Admin > Billing > Bookkeeping or you can create them yourself. If you do, create the accounts as current assets.

You will have to create the Stripe (fees) account yourself. Make sure you enable payments to be made from it. This account receives the fees as they appear in the Stripe feed. Use this account to pay the invoice from Stripe (step 3).

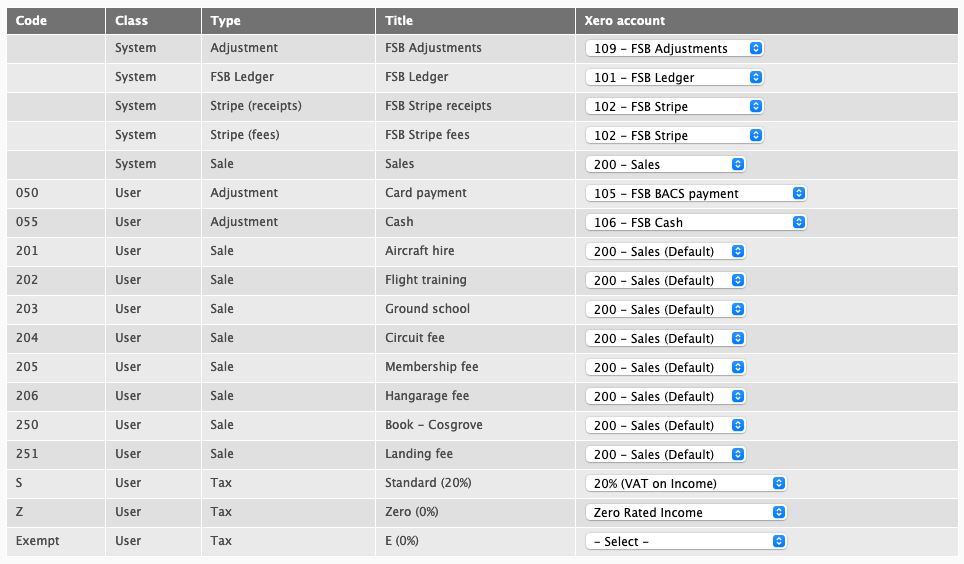

Once the required accounts have been mapped to Xero, you should see something similar to the following. You can map any other accounts you want to. If you have created "adjustment" accounts in Flight School Booking for payments made outside Stripe, it is a good idea to prefix these with "FSB" such as "FSB BACS Payments" so you can readily identify them.

Once all the required accounts and tax rates have been mapped, the export system can be turned on. Any transactions dated before the activation date will not be exported.

A useful feature of Xero is the option to create manual journals as drafts. This will allow you to try out the process and to check the entries without affecting your accounts.

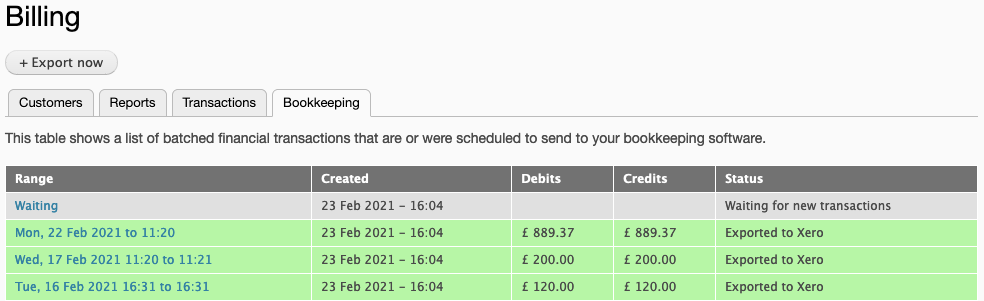

Flight School Booking runs a process overnight to creates manual journals, one for each day's transactions. You can view these on Billing > Bookkeeping.

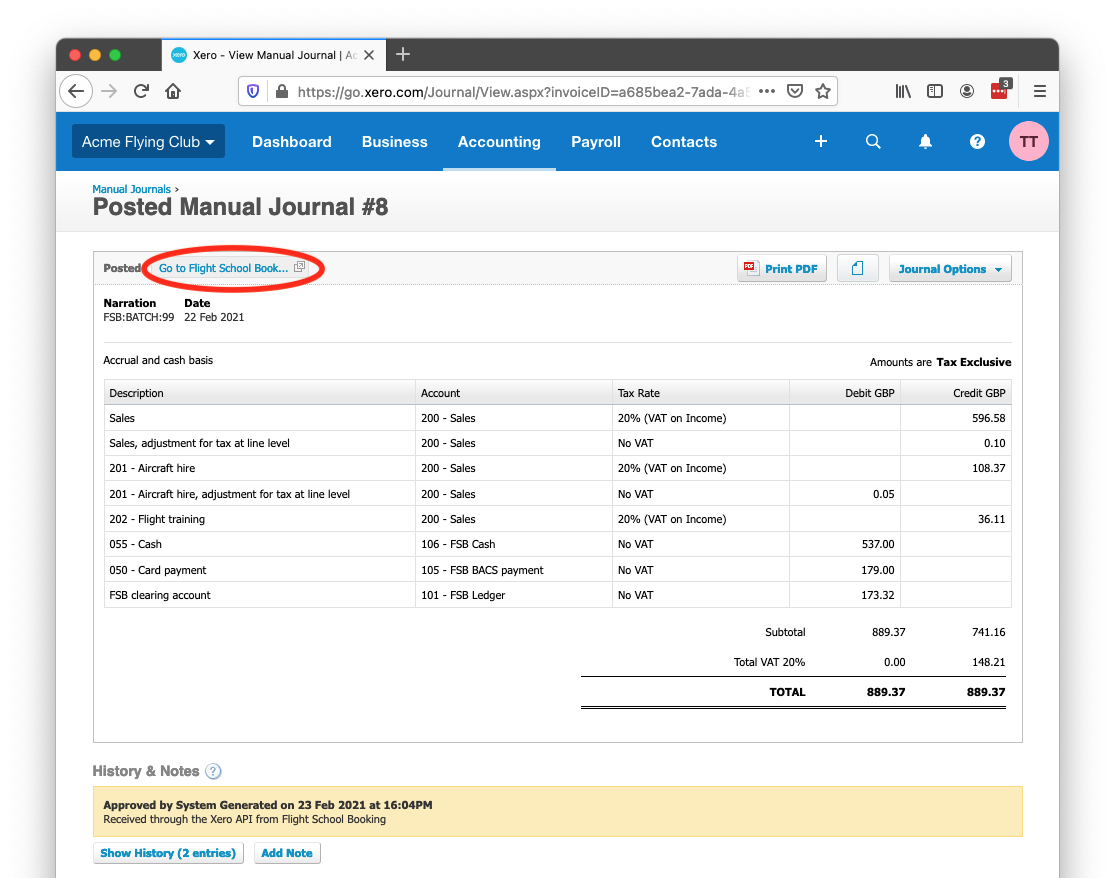

The manual journal can be viewed from the link, and also from Xero using the link in the journal as shown below.

The link opens the relevant page in Flight School Booking containing the transactions that make up the summary manual journal. This is useful if you need to track down a specific entry contained in a summary transaction in Xero.

The process runs fully automatically, but there are some simple jobs you still need to do, labelled STEP 1, 2 and 3 in the flow diagram at the top of this page.

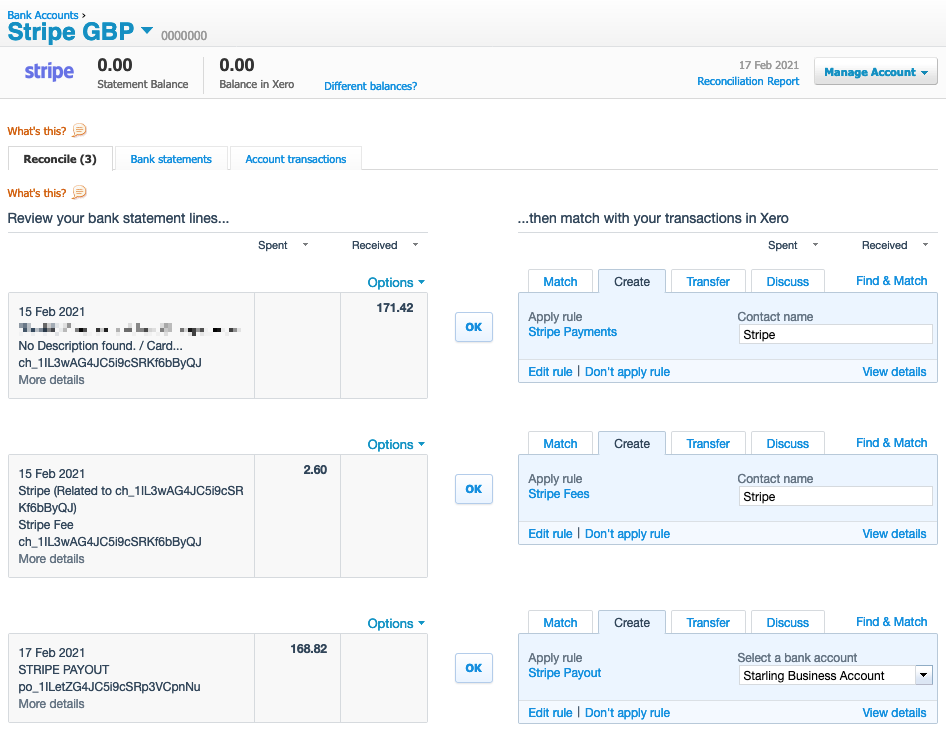

- Reconcile the Stripe bank feed. This can be automated using Bank Rules as follows.

a) Create a "Receive money rule" called "Stripe payments". When the description field contains "Flight School Booking", set the contact as Stripe and allocate the amount to the FSB Stripe clearing account.

b) Create a "Spend money rule" called "Stripe fee". When the description field contains "Stripe fee", set the contact as Stripe and allocate the amount to the Stripe (fees) clearing account.

c) Create a "Transfer money rule" called "Stripe payout". When the description field contains "Stripe payout" transfer the amount to the business bank account.

When reconciling Stripe using these rules, it should be a simple case of clicking OK:

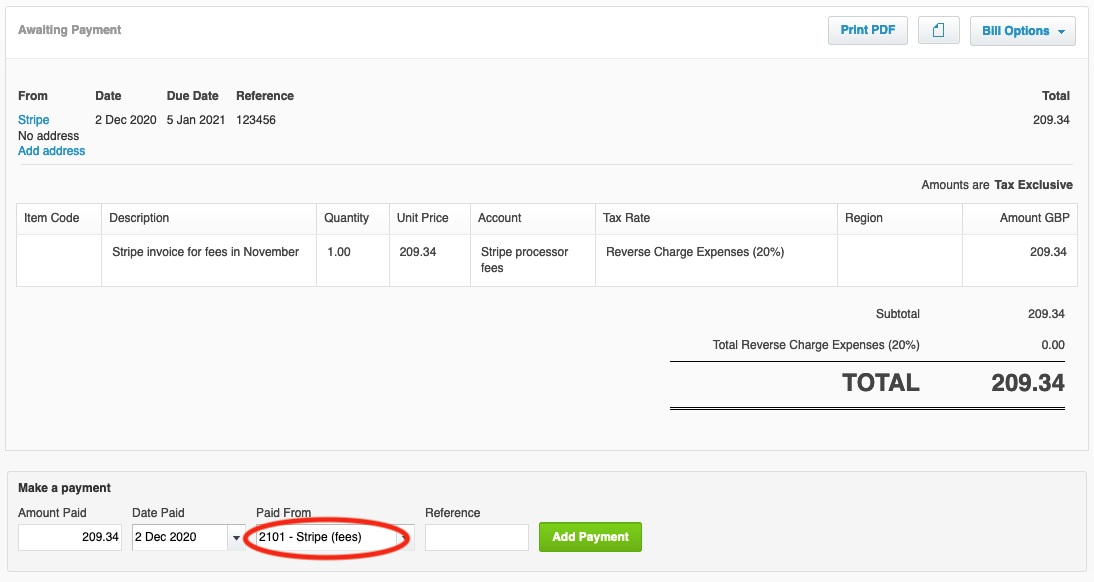

- Account for Stripe fees

Stripe produce tax invoices for their fees each month. Log in to Stripe and you'll find them under Settings > Documents.

Once you have downloaded the bill, enter it into your bookkeeping package like you would for any supplier invoice. Make a payment from the Stripe (fees) account. If this is not listed, you may need to enable payments for the account in Xero.

-

Reconcile payments outside Stripe.

If you receive payments outside Stripe, reconcile your bank feed with the other clearing accounts (for example, "FSB BACS Payments", "FSB Cash" and so on). As an example, if you receive cash for a sale, this will appear as a positive balance in your "FSB Cash" clearing account. When you deposit this into the bank and reconcile the bank feed, this reduces the balance on the clearing account back down.